We’re focused on fair and responsible

consumer lending solutions

Traditional finance has understimated tens of millions of Americans. Our mission is to offer them access to credit with fair and responsible terms.

How ADF helps

We believe the problem isn't risky customers. It's the way financial institutions have treated them. And so we built an innovative, AI-powered financing platform that allows us to match customers with loans they can afford to repay at risk-appropriate rates.

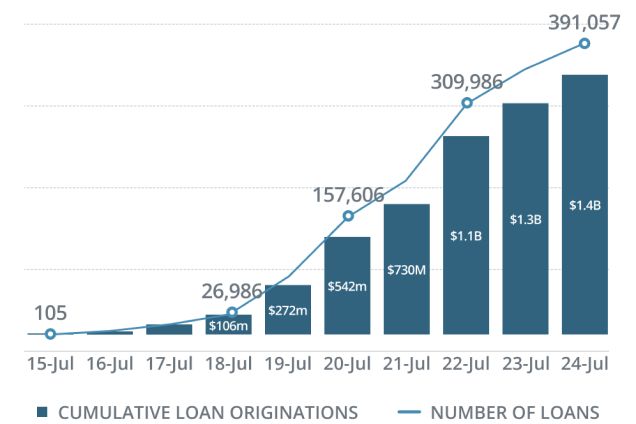

Our platform is highly scalable

AI-driven underwriting engines enable highly automated decisions

Artificial intelligence performance increases with scale

Our 100% digital lending platform is engineered to be deployed into new applications and asset classes

91% of the loans are fully automated

Latest news

-

SAN DIEGO, July 31, 2025 – Applied Data Finance (ADF), a fintech innovator dedicated to expanding fair and responsible credit access for underestimated U.S. consumers through AI-powered underwriting, today announced appointments to its executive and leadership teams, further solidifying its commitment to providing scalable, transparent, and data-driven lending solutions.

Deena Narayanaswamy Appointed EVP of Credit Risk

Deena Narayanaswamy has nearly two decades of experience in credit risk management and data science, having held senior roles at top fintech and financial services companies. Most recently, he served as Head of Credit at OnePay (formerly One) and previously held senior credit and data roles at Climb Credit, OppFi, Avant and FICO. Deena has also played critical roles in shaping predictive modeling and fraud prevention strategies in the fintech sector. He holds a Master of Science in Computer Engineering from the University of Minnesota and has completed executive education at the University of Chicago Booth School of Business.

At ADF, Deena will oversee the company’s enterprise-wide risk strategy, focusing on credit risk, fraud oversight, regulatory compliance, and model risk governance. He joins ADF’s executive leadership team and will play a pivotal role in scaling the company’s AI-driven lending operations.

Vijay Ravichandran Appointed EVP of Data Science and Analytics

Vijay Ravichandran brings ADF a wealth of experience from his time at leading fintech and financial services companies. Most recently, he was the Head of Decision Science at OnePay (formerly One), where he was part of the founding team for their India operations. Previously, he worked at Paytm and TransUnion where he led data science initiatives focused on credit risk and fraud prevention. He holds a Master of Science in Machine Learning and Data Science from Northwestern University.

Vijay’s deep knowledge of fraud mitigation, machine learning models, and data science governance will be instrumental as ADF continues to expand its AI-powered lending platform.

“Deena and Vijay are successful fintech executives with proven track records and extensive experience in credit risk, data science and AI that will further strengthen our platform offerings and empower ADF to provide fair credit access to underestimated consumers,” said Joseph Toms, CEO of Applied Data Finance.

-

Industry Veterans Join ADF to Drive Expansion in Consumer Finance and B2B Consumer Lending Solutions

SAN DIEGO, Calif. – March 06, 2025 – Applied Data Finance (“ADF”), a consumer-focused fintech company leveraging the power of people, data analytics, and technology to help consumers achieve financial success and security, today announced the appointment of Todd Rice as Chief Revenue Officer (CRO) and Anthony Nyikos as Vice President of Growth. These strategic hires reinforce ADF’s commitment to expanding its lending and B2B consumer lending solutions, enhancing financial access for underestimated consumers, and strengthening partnerships within the financial services ecosystem focused on consumers.

Rice joins ADF with extensive expertise in scaling consumer finance businesses and optimizing lending operations, while Nyikos brings deep experience in strategic partnerships and business development. Having previously served as Vice President of Strategic Partnerships at ADF for seven years, Nyikos’ return signals a renewed focus on leveraging ADF’s AI-powered risk assessment and compliance technology to expand industry collaborations.

"ADF is redefining the way consumer finance companies approach credit risk, compliance, and financial empowerment by having experienced professionals use leading-edge technology and data to produce great outcomes," said Joseph Toms, Chief Executive Officer, Applied Data Finance. "Todd and Anthony bring invaluable experience in scaling financial services and building strategic alliances. Their leadership will accelerate our mission to provide our customers with responsible financial solutions while developing new technologies for consumer-facing companies."

Todd Rice – Chief Revenue Officer

With nearly 30 years of leadership in consumer finance, Rice has successfully built and led lending teams at top financial institutions. Most recently, he was the Founder and CEO of New Credit America, a consumer finance company. His prior roles include executive leadership at First USA (Chase) and Citigroup; he also served as Executive Vice President at Providian Financial (WaMu Card Services), responsible for all cardmember acquisition marketing. Rice was also an early-stage executive at Opportun. As CRO, Rice will drive ADF’s revenue strategy, ensuring AI-powered lending solutions and compliance platforms reach the right markets while maintaining ADF’s commitment to responsible financial innovation.

Rice holds a Bachelor of Business Administration degree from Texas A&M University and an MBA from New York University.

Anthony Nyikos – Vice President of Growth

Nyikos brings nearly three decades of experience in financial services, strategic partnerships, and business development. Before rejoining ADF, he served as Partner Executive at Pathward, where he focused on establishing and growing key lending partnerships. Prior to that, he was Vice President of Strategic Partnerships at Monevo, working closely with financial institutions to develop tailored credit solutions. He also spent nearly eight years as Vice President of Strategic Partnerships at ADF, where he played a key role in expanding the company’s industry relationships. In his new role, Nyikos will focus on strengthening ADF’s partnerships with financial institutions and fintech companies, helping expand ADF’s Lending-as-a-Service (LaaS) and AI-driven compliance solutions.

-

SAN DIEGO - July 8, 2024 – Applied Data Finance (ADF), which operates a leading technology-enabled consumer lending services platform, today announced the appointment of Joseph Toms as its new Chief Executive Officer. Toms, who most recently served as the Head of Consumer Lending at Axar Capital and has been a member of ADF’s Board since November 2023, succeeds Co-Founder Krishna Gopinathan, who will transition to a board role and advisory position while pursuing his interests in artificial intelligence.

Toms is a seasoned executive with over 35 years of experience in consumer finance and asset management. His visionary leadership and strategic acumen have consistently propelled companies to industry-leading positions, setting new benchmarks for performance. At Axar Capital, Toms supported the firm’s consumer finance strategy. Prior to Axar, he launched Freedom Financial’s (later Achieve.com) successful lending division. Under his leadership, the division grew into a highly profitable consumer lending business, with a top-performing $2 billion consumer credit fund and a robust securitization program that received AAA ratings from two separate rating agencies.

“Krishna has built an incredible foundation, and I am committed to building upon it and leading ADF into its next phase of growth and success,” said Toms. “Over the past several months, I have had the privilege of working closely with the talented team at ADF and have been consistently impressed by their dedication, expertise, and customer-centric approach. ADF’s sophisticated risk pricing abilities, driven by its advanced data-science capabilities and cutting-edge analytical approach, set the company apart in the industry. I look forward to working with the entire ADF team to continue delivering innovative and responsible credit solutions to our customers.”

Toms’ appointment follows the company’s successful refinancing and growth equity capital infusion in late 2023, which will allow ADF to continue growing while also exploring new opportunities for innovation and expansion.

“I am delighted to welcome Joe as the new CEO of Applied Data Finance,” said Gopinathan, who co-founded ADF in 2014 and has served as its CEO for the better part of a decade. “His extensive background in consumer finance, combined with his intimate understanding of ADF’s business as a board member, positions him perfectly to lead the company forward. I have full confidence in his ability to drive ADF’s success, and I look forward to working with him in my new capacity as a board member and advisor.”