Lending as a Service

Our unique approach sets us apart from other FinTech platforms

Uses next-generation underwriting, a fully automated approach with data- and optimization-driven characteristics

Leverages knowledge of consumer behavior across the full credit spectrum, enabling us to effectively price, manage, and monitor risk at a higher level

Incorporates risk, prescreen, conversion, fraud, and lifetime profitability models

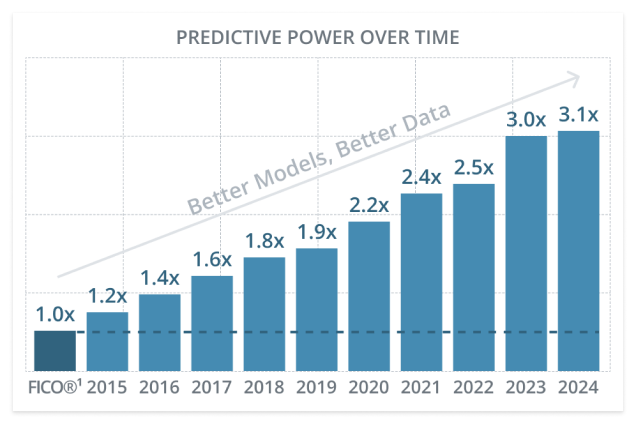

Our AI models offer a better way to measure credit risk

Refined over 10 years

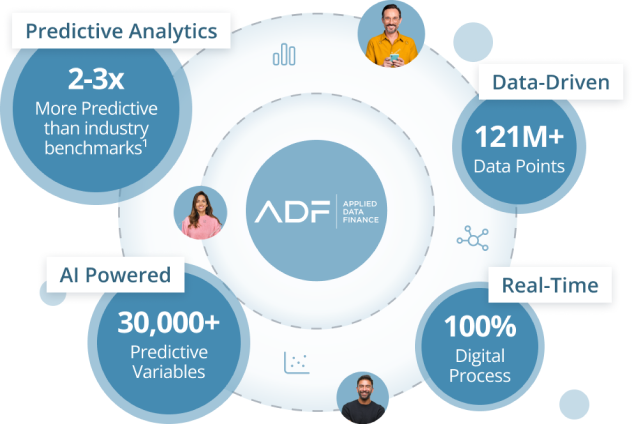

Trained on more than 121 million data points

Drawing on more than 30,000 predictive variables

More predictive than industry benchmarks

Rich datasets and unmatched AI power the accuracy of our scalable, real-time credit decisioning systems.

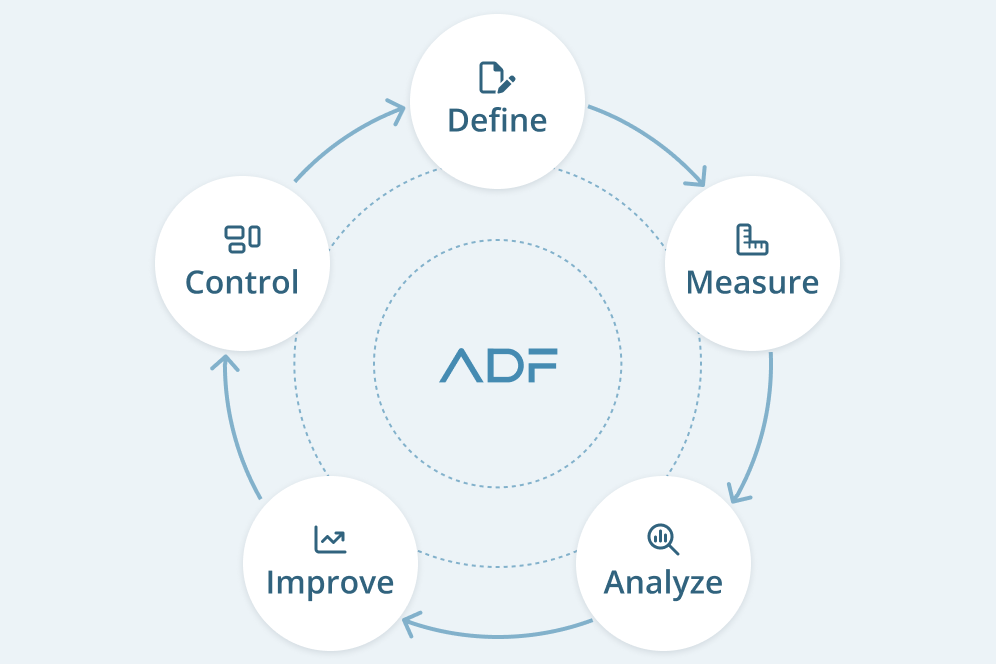

Our culture of continuous innovation transcends the business

We operate under a Lean Six Sigma methodology

We leverage data science, artificial intelligence and machine learning not just to assess credit and fraud risk...

...but also for marketing, prepayment, conversion, compliance and customer service