Our Technology

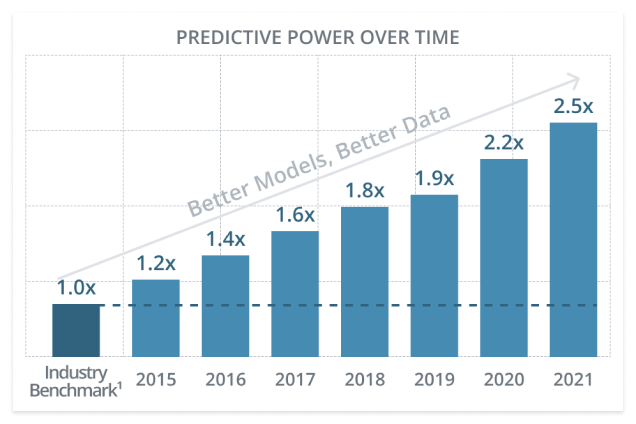

Our AI models offer a better way to measure credit risk

- Refined over 9 years

- Trained on more than 121 million data points

- Drawing on more than 30,000 predictive variables

Our unique approach sets us apart from other FinTech platforms

- Uses next-generation underwriting, a fully automated approach with data- and optimization-driven characteristics

- Leverages knowledge of consumer behavior across the full credit spectrum, enabling us to effectively price, manage, and monitor risk at a higher level

- Incorporates risk, prescreen, conversion, fraud, and lifetime profitability models

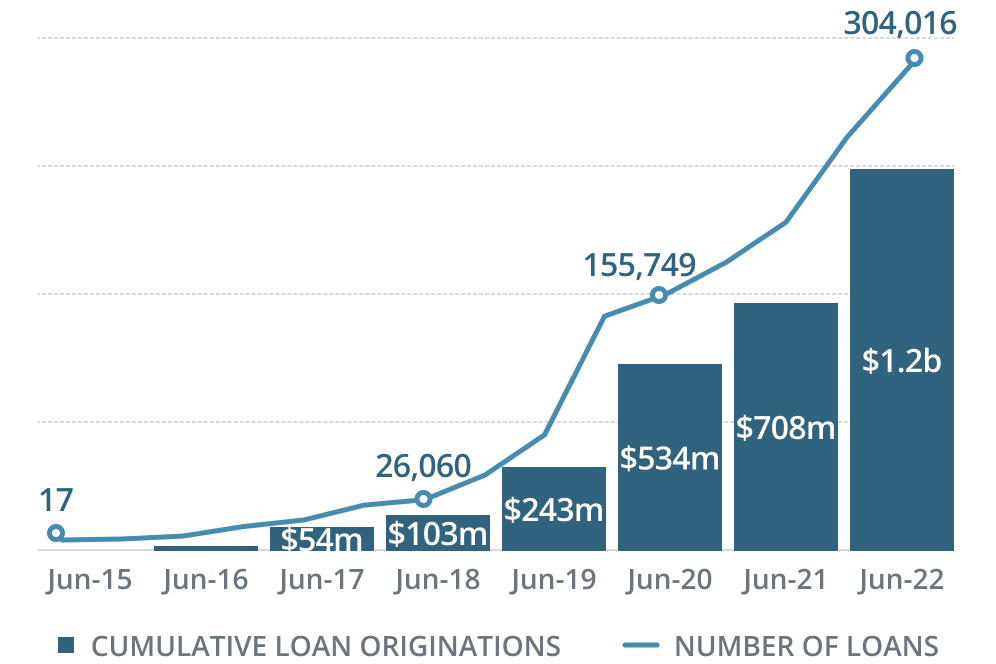

Our platform is highly scalable

- AI-driven underwriting engines enable highly automated decisions

- Artificial intelligence performance increases with scale

- Our 100% digital lending platform is engineered to be deployed into new applications and asset classes

- 91% of the loans are fully automated

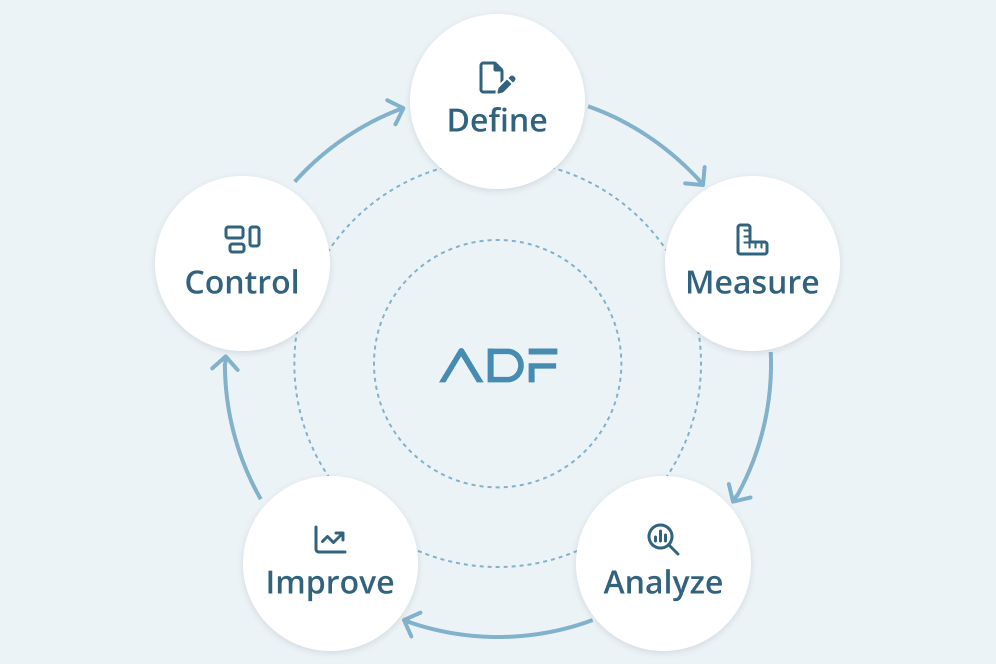

Our culture of continuous innovation transcends the business

- We operate under a Lean Six Sigma methodology

- We leverage data science, artificial intelligence and machine learning not just to assess credit and fraud risk...

- ...but also for marketing, prepayment, conversion, compliance and customer service

Get in touch

1 AI models’ predictive performance measured using the Kolmogorov-Smirnov (KS) statistic on the ADF portfolio.